JACKSONVILLE – When the proposed flood insurance rate maps for Onslow County were released back in 2016, Jacksonville officials were surprised to say the least.

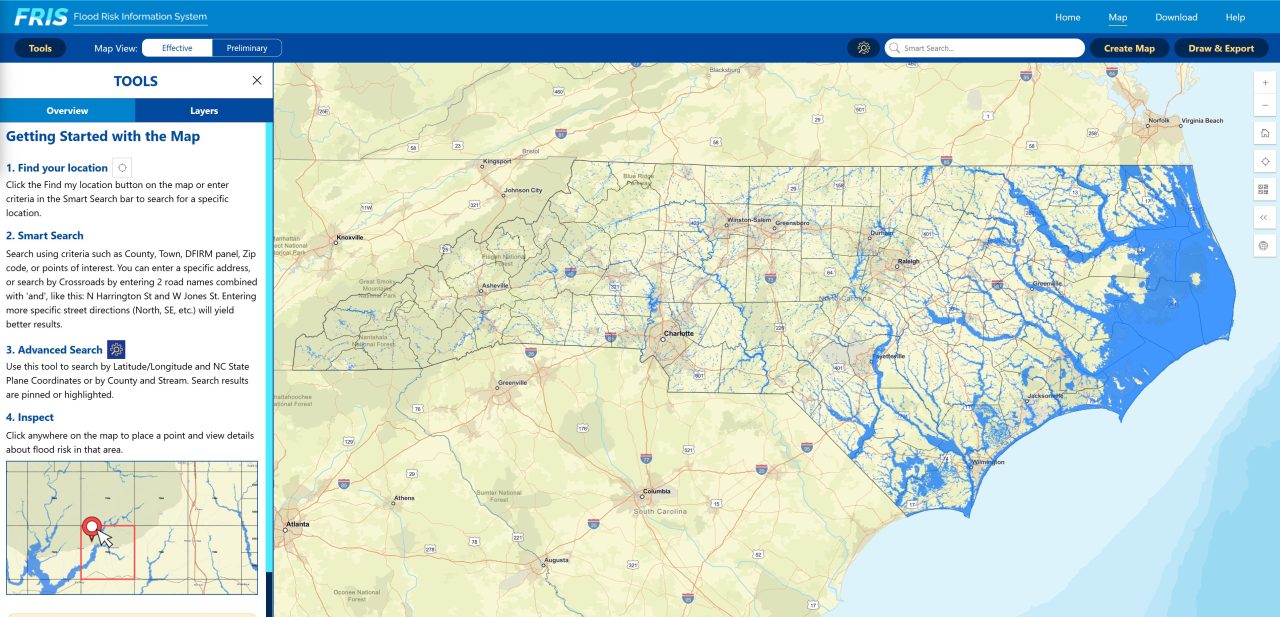

The preliminary maps created under North Carolina’s Flood Plain Mapping Program shifted more than 800 additional structures in downtown Jacksonville into a high-hazard flood zone.

Supporter Spotlight

“Jacksonville had the highest number percentage-wise increase of anywhere in the state,” said Ryan King, the city’s director of planning and inspections. “That was an eye opener for us because, if you look at it, we don’t have a lot of areas that flood. We don’t have a lot of structures that flood. Now, we have some, don’t get me wrong, but we don’t have a lot.”

King spoke with Coastal Review last week during an open house the city hosted for residents and business leaders to review and discuss proposed updated flood studies and revisions to the maps that have been made following the city’s appeal.

Special flood hazard areas, or SFHAs, are identified as areas with a 1% or higher annual risk of a flood. Unlike moderate to low-risk areas, where flood insurance is recommended, but optional, flood insurance and federally backed mortgages are required in high-risk zones.

Jane Sutton and her husband have opted against buying flood insurance, telling Coastal Review that their property, two blocks from the New River, does not have a history of flooding.

“I can tell you as long as I’ve lived here and as many hurricanes as I’ve lived through our neighborhood has never flooded,” Sutton said.

Supporter Spotlight

The couple were among the first area residents who trickled into the open house last Wednesday. They were relieved to learn their property will not be affected under the proposed revised maps.

Under the 2016 preliminary maps, which were largely based on storm surge modeling, many downtown homes would have to have been elevated, some as much as 10 feet. That would be on top of the city’s 3-foot freeboard requirement above base flood elevation.

“In the downtown area, which is an area that jumped out at me, you went to an elevation of 10,” King said. “I think that area should be in a flood zone because the houses do flood. But I think the number seemed off at 10 feet.”

There were other things that raised city staff’s concerns. Some properties in Carolina Forest, a residential neighborhood of townhomes and single-family homes roughly 5 miles from downtown, were included in a flood zone based on data from 2000, King said.

Construction of that neighborhood didn’t get underway until after that year.

After city staff shared their concerns with Jacksonville City Council, the board agreed to hire design, engineering and consulting firm Applied Technology & Management Inc. to take a deep dive into some of the discrepancies being pointed out by staff.

The city formally appealed 33 blocks, or areas of land divided into smaller sections on flood maps, identified in the revised maps the Federal Emergency Management Agency released in 2016.

North Carolina received FEMA’s approval some two decades ago to take over the state’s Flood Plain Mapping Program, a move supported by those who believed map updates are best handled at the local level by people who are familiar with the areas under review.

Revised preliminary maps were released in late March 2024.

The maps incorporate newer data, including information gathered using LiDAR, or Light Detection and Ranging, which uses laser light to measure distances and create detailed models of the environment.

The proposed revised maps do not, however, factor in sea level rise.

“And we know, from what I’ve been told, the next revision will incorporate sea level rise so we want to make sure that we get it right this time because I think it’s just going to stack on top of it as we move forward. So, this is almost like the new baseline,” he said.

Beginning Sept. 18, property owners will have 90 days to appeal the 2024 revisions. That appeal period closes on Dec. 18.

King encourages Jacksonville property owners to contact their insurance agents to inquire about flood policies.

“It’s worth reaching out to find out to protect your property, but that’s a conversation the homeowner needs to have with the insurance company,” he said.