Guest commentary

If you bought a home in North Carolina, you likely were never told whether it had previously flooded or whether you are legally required to purchase flood insurance, let alone the cost of that insurance.

That’s because in North Carolina the seller of a property does not have to disclose any of this information.

Supporter Spotlight

A study produced by Milliman, an international insurance actuary, estimated that 13,237 homes were purchased in 2021 in North Carolina that had previously been damaged in floods. None of the sellers of those homes were required to tell the buyers about the history of flood damages. And a home that has flooded once is likely to flood again.

Milliman estimated that North Carolina home buyers who purchased a previously flooded home will pay, on average, $18,164 in unanticipated damages over a 15-year mortgage and $36,328 over a 30-year mortgage. As flood disasters become more frequent and severe and sea levels rise, those damages will climb considerably.

For most of us, if we were to choose between living in a home that’s never flooded and a home that’s flooded repeatedly, we’d choose the one that’s never flooded. Why? Because fleeing rising floodwaters, losing your possessions, and having to spend months cleaning up and rebuilding drains your bank account and it’s incredibly stressful. However, if we do not have the right to know a home’s flood history and risk, then we can be unknowingly forced into this exact situation.

The North Carolina Real Estate Commission is now poised to remedy this problem and grant home buyers the right to know a home’s flood history and other flood risk information. On Aug. 1, the commission closed a public comment period on changes to the state’s mandatory disclosure form. The commission will likely add a series of important questions about flooding that sellers will have to answer and provide to a home buyer – for the first time ever.

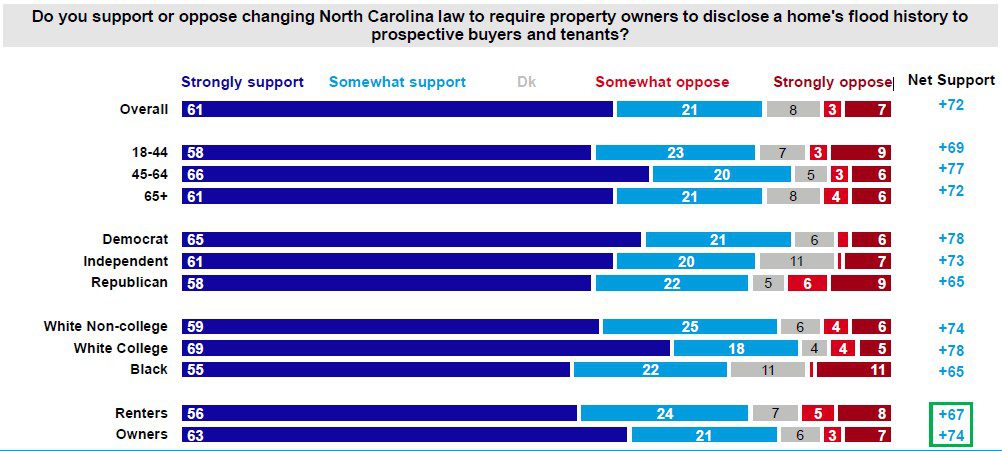

The overwhelming majority of North Carolina residents agree with the commission that this is the right decision. In a poll conducted by the Global Strategy Group, 83% of North Carolinians supported a requirement that sellers tell renters or home buyers the truth about past flooding. Republicans and Democrats, people in the mountains and along the coasts, people of all races and walks of life all agreed that it was wrong to hide such information.

Supporter Spotlight

strong support across partisans and among renters and owners. Source: Natural Resources Defense Council NC utility study

The Real Estate Commission is to be congratulated for putting this policy out for public comment and making sure home buyers are fully informed. It’s unfair that someone selling a house knows about flooding problems and can hide that from the buyer – who is left to find out for themselves after the next flood.

Given the state’s ongoing recovery from hurricanes Matthew in 2016, Florence in 2018, and other flooding events that have occurred throughout the state, this decision is long overdue.

As we enter the most active part of 2023 hurricane season, the commission is taking the right step at the right time.

To stimulate discussion and debate, Coastal Review welcomes differing viewpoints on topical coastal issues. See our guidelines for submitting guest columns. Opinions expressed by the authors are not necessarily those of Coastal Review or our publisher, the North Carolina Coastal Federation.