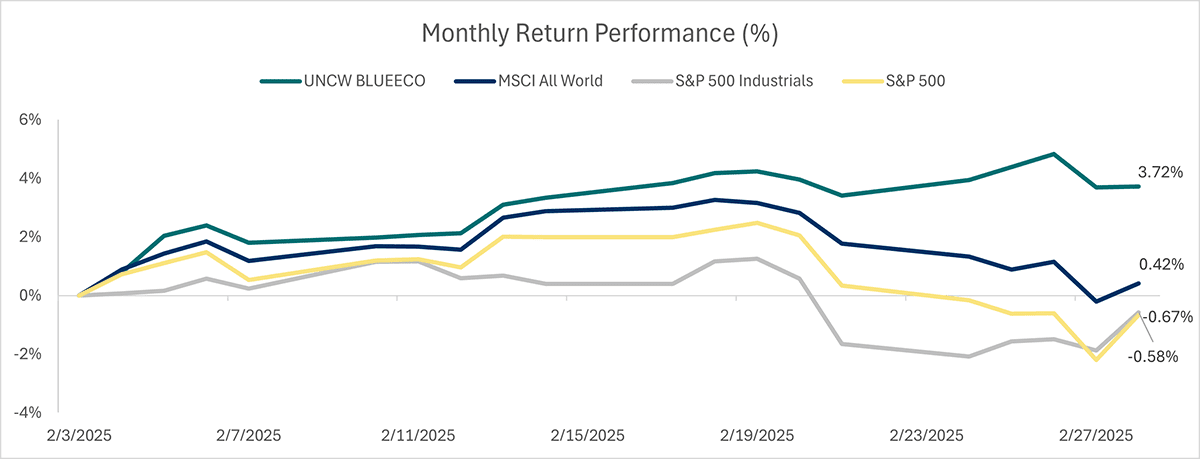

The University of North Carolina Wilmington business school’s measure of ocean-based industrial performance showed mixed results during February but outperformed the indices described as its closest benchmarks.

The UNC Wilmington Blue Economy Index (Bloomberg Ticker: BLUEECO) tracks the economic activities in the oceans based on the World Bank definition of the Blue Economy. The index rose by 3.7% in February, beating the MSCI All World Index, the S&P 500, and the S&P Industrials, which showed flat to negative returns during the month, mostly attributed to the Trump administration’s chaotic trade policy.

Supporter Spotlight

Goldman Sachs earlier this week lowered its year-end S&P 500 projections after the index on Monday saw its biggest single-day slide since Dec. 18, erasing $4 trillion in gains.

Among blue economy sectors, the energy sector saw the worst performance in February, slipping by 14.7%. “The drop was mainly due to geopolitical tensions and policy decisions, particularly ongoing U.S. tariffs,” UNCW said in announcing the results.

Consumer demand was also down significantly.

The UNC Wilmington Blue Economy Index was developed in collaboration with the UNCW Cameron School of Business, UNCW Center for Innovation and Entrepreneurship, or CIE, CIE’s Alliance for the Blue Economy, and FactSet. The index measures economic activities in oceans and waterways.

February was the second straight month of positive return from the UNCW Blue Economy Index.

Supporter Spotlight

The materials sector led with a 4.3% gain; industrials followed with a 4% gain; utilities a 3.6% gain; consumer staples were down 6.6%; and consumer discretionary sector down 12.8%.

The consumer discretionary sector was dragged down by poor performances from Carnival and Norweigian Cruise Line that UNCW officials said were partly due to a policy change requiring them to pay federal income tax in the U.S.

“After previously flying ‘flags of convenience,’ which allowed them to avoid U.S. income tax, this new requirement will negatively affect their earnings,” according to the announcement.

Materials, the strongest performer during February, saw demand for commodities, particularly in the United States and China, as well as higher commodity prices globally.

Four of the top five performers in the BLUEECO Index were in the industrials sector: Wisdom, U Ming Marine, Esco Technologies, and A P Moller Maersk.