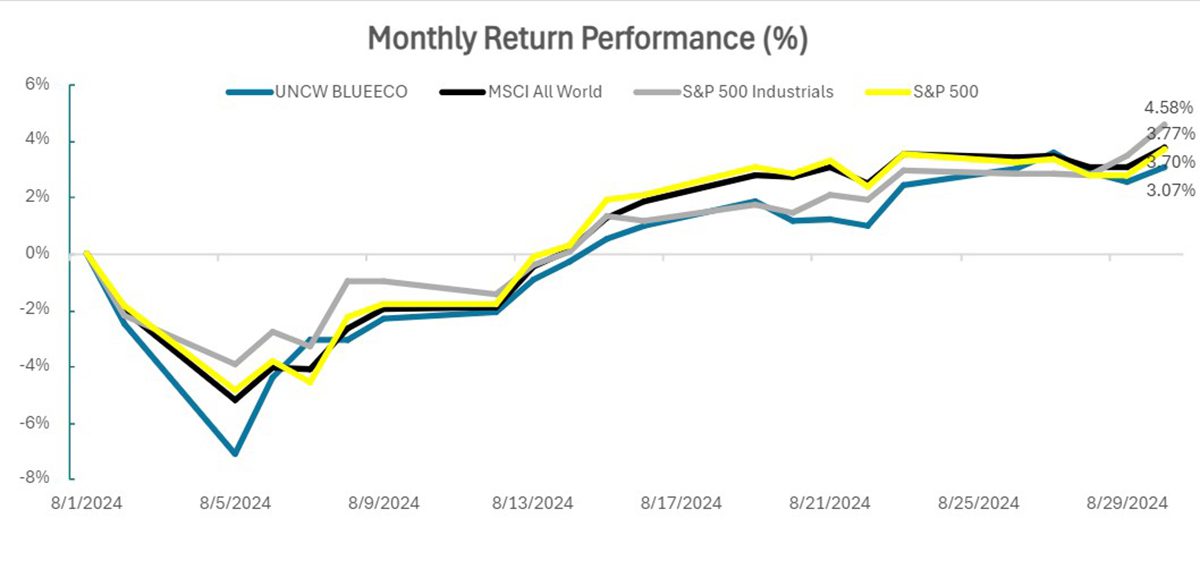

The University of North Carolina Wilmington said Wednesday that its Blue Economy Index rose by 3.07% in August but still slightly underperformed its closest benchmarks.

The UNCW Blue Economy Index measures the economic activities in the oceans and follows the World Bank definition of the Blue Economy. It was originally developed in 2018 but officially launched in this year in February.

Supporter Spotlight

“The modest performance from BLUEECO doubles the performance of last month’s return,” UNCW said in a press release.

The UNC Wilmington Blue Economy Index was developed in collaboration with the UNCW Cameron School of Business, UNCW Center for Innovation and Entrepreneurship, CIE’s Alliance for the Blue Economy, and FactSet, a global data and software firm. The UNCW index measures economic activities in oceans and waterways and places an emphasis on environmental impact, offering investors insights into what its developers describe as a “burgeoning economic landscape surrounding coastal communities.”

While the index underperformed the MSCI All World Index, the S&P 500, and S&P Industrials, according to the UNCW analysis, the benchmarks delivered similarly modest gains during the month.

That’s except for the S&P Industrials, which experienced a 4.58% increase in August. The MSCI and S&P 500 showed gains of 3.77% and 3.70%, respectively.

“Since April 27th, 2018, our index has outperformed MSCI All World Index by 11.91%, making it very appealing to investors,” Colin Waltsak, a research assistant in the UNCW Economics and Finance Department, told Coastal Review Wednesday. “Not only this, but the United Nations believes the Blue Economy will grow over 50% by 2030. Our index is a great tool for investors who are aiming to capture long term growth of the Blue Economy and shines light on the economic importance of coastal communities.”

Supporter Spotlight

The sector saw majority positive contributions to the index, according to university index analysts. The materials and real estate sector helped the index performance by posting returns of 4.99% and 4.89%, respectively. The energy sector, however, dipped into the negatives with returns of -6.82% over the month, according to the UNCW analysis.

UNCW noted that the materials sector was dominated by Schouw and Co., a supplier of feed for aquaculture. Schouw also is one of the largest suppliers of hydraulics in Denmark, producing hydraulic systems for industries including offshore wind energy.

The top performer within the index was CS Wind, a South Korea-based company specializing in manufacturing and sales of wind towers for offshore wind energy. CS Wind saw an increase of 29.48%, attributed to an earnings statement showing 99% growth over the year. The company had acquired Vesta Towers America, providing entry to the North American market.

The worst performer in the index was Grieg Seafood, a Norwegian salmon farming company that saw a 17.77% decrease over the month attributed to reduced harvest volumes, down by 7,000 tons. “The company also faced challenges with fish health and environmental issues which led to a higher mortality rate, straining operations, and contributing to economic loss,” UNCW officials said in the analysis.