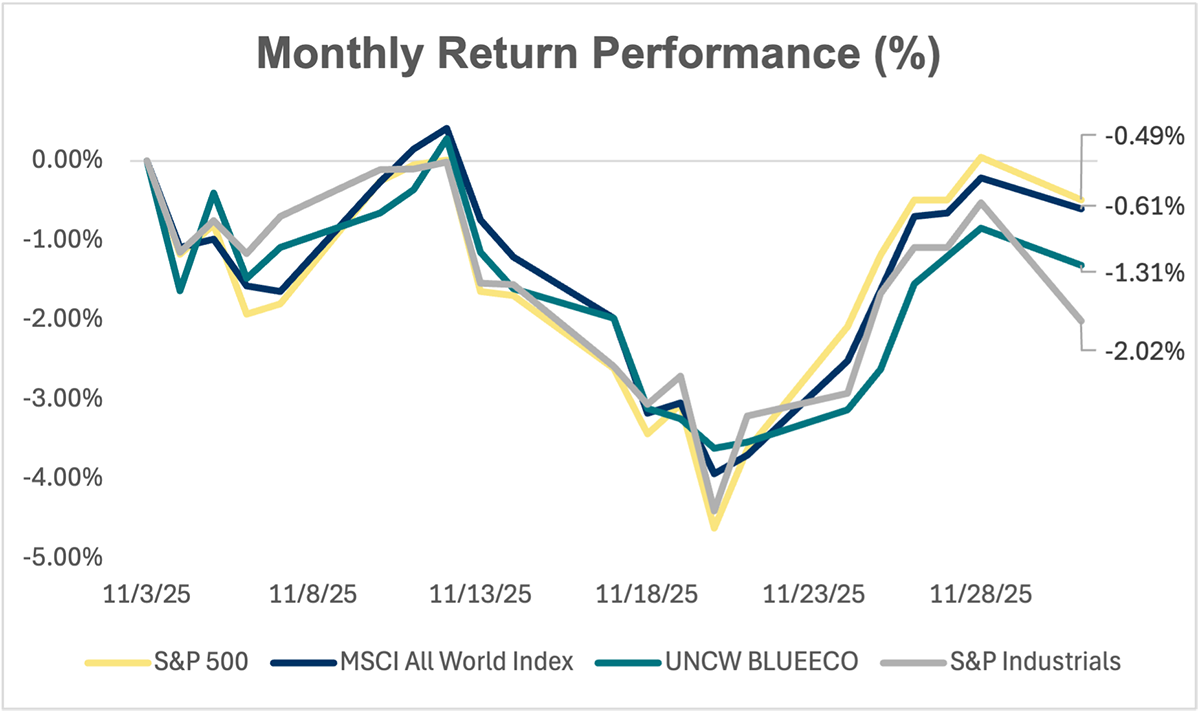

The sector known as the Blue Economy, which includes companies operating on oceans and waterways that are focused on environmental sustainability, saw a 1.36% decline in November, according to the University of North Carolina Wilmington Blue Economy Index, but still showed relative stability compared with industrial benchmarks.

By comparison, in November, the S&P 500 was down 0.57%, the MSCI All World Index, which measures global equity portfolio performance, dropped 0.66%, and the S&P Industrials Index ended the month with a 2.07% decline.

Supporter Spotlight

The Blue Economy Index (Bloomberg Ticker: BLUEECO) slipped from 2,592.91 to 2,557.57, “reflecting broad-based softness across global equity markets,” according to a UNCW news release.

“November’s decline was driven by weakness across industrial, maritime, and consumer-related segments as global risk sentiment softened,” the release continues. “Cooling manufacturing activity, lower freight demand in key trans-Pacific routes, and cautious spending patterns in developed markets contributed to a more defensive posture among investors.”

The November results, while reflecting what UNCW called “a broadly negative month for global markets,” were buoyed by the index’s diverse mix of marine transport, renewable infrastructure, and essential services companies.

Consumer discretionary spending was down 5.71%, reflecting weaker seasonal demand for leisure, travel and discretionary goods. “Slowing economic momentum and reduced spending appetite weighed on retail-linked and service-oriented holdings,” UNCW said.

Consumer staples, however, increased 1.18% in November, the month’s only gain. “Strong demand for essential goods, along with resilient pricing in food and aquaculture producers, supported modest gains despite broader market weakness,” according to the university.

Supporter Spotlight

Utilities were down 1.48%, reflecting what UNCW called “softer sentiment toward renewable and grid-focused firms as project timelines and regulatory decisions remained in flux. Nonetheless, core power and distribution operators maintained stable operational fundamentals.”

Industrials declined 1.13%, which UNCW said was due to lower freight volumes, moderating shipbuilding activity and softer machinery demand across Asia and Europe. “Despite the downturn, the sector remained more resilient than the broader industrial benchmark,” UNCW said.

Notable gains that helped cushion overall Blue Economy Index performance included Himalaya Shipping, which rose 20.48%; Vestas Wind Systems, which posted a 16.62% gain as renewable equipment supply chain sentiment improved and turbine orders rebounded in key markets; and Wallenius Wilhelmsen, which posted a 14.95% gain driven by vehicle logistics demand and continued strength in roll-on/roll-off shipping activity.

“Together, these names demonstrated the index’s capacity for selective outperformance even during periods of broader market weakness,” according to the release.

The Blue Economy Index was developed in collaboration among the UNCW Center for Innovation and Entrepreneurship, the Alliance for the Blue Economy, or AllBlue, and the Cameron School of Business, and it relies on data from FactSet. UNCW says the index “represents a fusion of academic insight, environmental science, and financial market expertise.”

The index measures the performance of leading global firms that demonstrate both commercial viability and environmental responsibility, aligning with the World Bank’s definition of the Blue Economy: “the sustainable use of ocean resources for economic growth, improved livelihoods, and jobs while preserving the health of the ocean ecosystem.”

It serves to provide investors “a timely and transparent benchmark for evaluating the sustainable growth potential of ocean-based sectors such as shipping, offshore energy, aquaculture, and marine infrastructure,” according to the release.