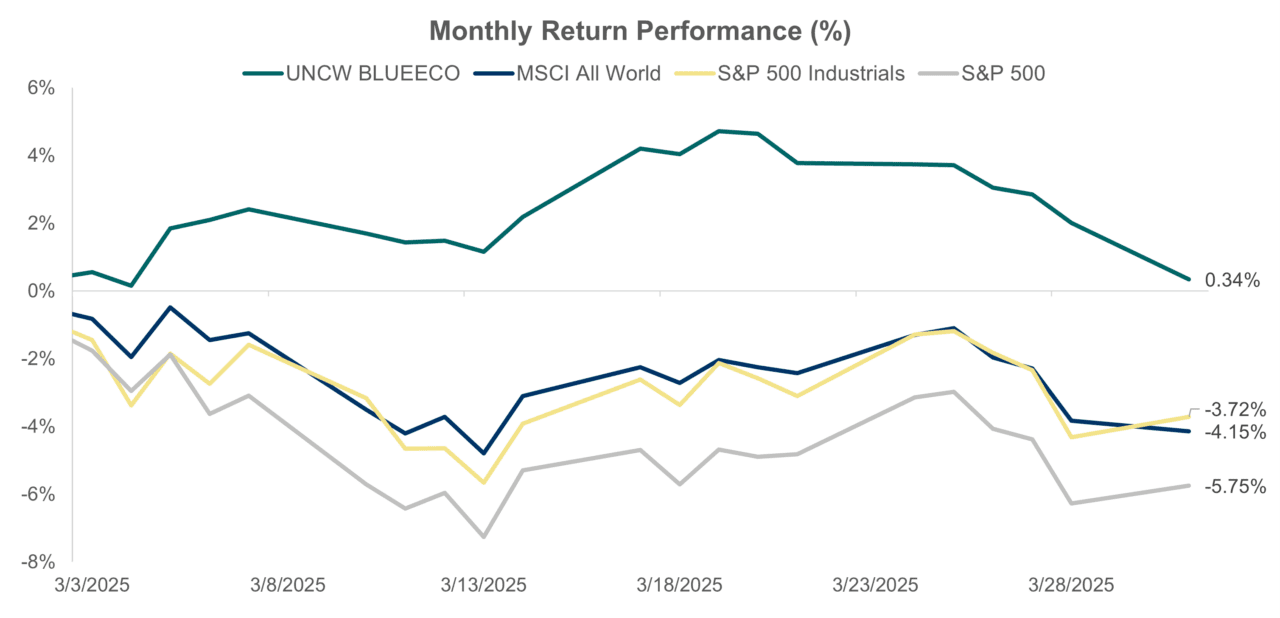

The University of North Carolina Wilmington Blue Economy Index delivered a positive return during March amid a troubled and volatile broader market.

The index (Bloomberg Ticker: BLUEECO), a measure of ocean-based industrial performance based on the World Bank definition of the blue economy, realized a return of 0.3%, ending the month at 1,934.5, compared to its February closing value of 1,928.0.

Supporter Spotlight

Major market indices, the S&P 500, MSCI All World Index, and S&P Industrials, reported significant losses with returns of -5.8%, -4.1%, and -3.7%, respectively, during the same period.

The index’s daily performance throughout the month fluctuated but showed a generally upward trend, reaching a high of 2,019 points on March 19.

“Given that BLUEECO tracks the economic activities in the oceans and waterways with a focus on environmental impact, the index’s strong performance highlights the underlying resilience and growth potential of the blue economy sectors during periods of broader market uncertainty,” according to a UNCW news release.

The materials sector of the blue economy saw a 9.3% return driven by strong performances from companies like Schouw and Co., which specializes in producing feed for aquaculture industries, including salmon, trout, sea bass, sea bream and shrimp farming.

“This surge can be attributed to positive market sentiment stemming from expectations of lower interest rates, growing investment in sustainable marine-based materials, and increasing global demand for biomaterials amid ongoing trade tensions,” officials said.

Supporter Spotlight

The consumer discretionary sector realized the steepest decline among all sectors, falling by 15.1%.

“This downturn indicates a notable shift in consumer spending habits, potentially driven by factors such as rising prices, increased debt, and economic uncertainty,” according to the release. “As consumers increasingly prioritize essential purchases over discretionary items, companies such as Carnival, Lindblad Expeditions Holdings, and Norwegian Cruise Line Holdings have been adversely affected, placing them among the weakest performers in the index.”

Consumer staples posted a moderate gain of 3.4%, followed by utilities, which increased by 2.6%.

The index was developed in collaboration with the UNCW Cameron School of Business, UNCW Center for Innovation and Entrepreneurship, CIE’s Alliance for the Blue Economy, and FactSet.