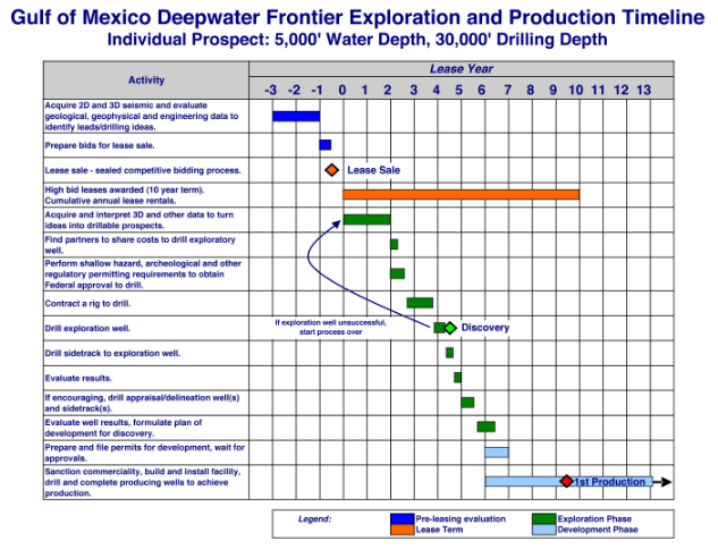

This timeline of offshore leasing and drilling was compiled from material supplied from the American Petroleum Institute, the country’s largest oil industry trade group.

An offshore lease is only a rental agreement with no guarantee that the leased area contains any oil or natural gas. In fact, most leased areas don’t contain oil and gas in commercial quantities.

Supporter Spotlight

Companies invest as much as hundreds of millions of dollars to acquire and maintain their offshore leases. When it buys a lease, a company gets the right to risk its limited investment capital to explore for resources and to produce them if the search yields a commercial discovery.

Since the only way for a company to recover this initial investment is to start production on a lease, there is a significant financial incentive to develop these resources in a timely manner. Companies are required under government leasing regulations to develop a lease between five and 10 years depending on the area and water depth or return it to the government. In general, leases not producing by the end of their term are relinquished back to the government, which can then re-lease them. All the money spent by the company to acquire and keep the lease is then lost.

The timeline from lease to production can vary from four to 10 years depending on water depth at the lease location, the drilling depth needed to reach the target reservoir, the distance from shore and from infrastructure, the geological characteristics of the reservoir and complexity of production facilities design.

Capital costs can be considerable for offshore projects, particularly those in deep water. Marine seismic surveys can cost upwards of $200,000 a day. The cost of offshore exploratory wells can range from $25 million to more than $100 million for some deep water prospects. It’s not unusual for a company to spend more than $100 million on an exploratory well only to come up empty with a dry hole.

If a company finds commercial quantities of oil or natural gas, the subsequent design and installation of the deep water production rigs may cost in excess of $1 billion.

Supporter Spotlight

In general, from purchase of the lease to first production can take anywhere from 7 to 10 years in areas that have existing infrastructure. In those instances, the timeline for exploration and production can include:

- Six months to a year for federal administration and execution of lease sales in unleased areas.

- One year for preliminary geological investigation and selection of areas of interest for additional seismic data acquisition.

- One year to two years to acquire and to process 3D (and new wide azimuth) seismic data, and to identify drillable prospects from this data.

- As much as a year or more to contract and schedule a drilling rig.

- Six to 10 months for drilling and completion of an exploratory well.

- Six months to a year for follow up evaluation of drilling results, which can include drilling a sidetrack well.

- Another two to three years for additional delineation drilling, and formulation of a plan for reservoir development if the exploratory well proves successful. During this time, the company also is working on pre-permit studies, permitting and design and procurement for production facilities, including surface and subsurface equipment and systems.

- One year or more for facilities installation, followed by development drilling, which may take from one to two additional years. During this period, the company is involved in design, permitting, engineering, procurement and installation of a pipeline or offshore mooring system to bring the production to market.

One recent example is Anadarko’s Independence Hub, a natural gas facility in 8,000 feet of water about 120 miles from Mississippi. The lease was purchased in the Sale 181 area in December 2001. The first exploratory well was drilled in 2003, with first production seen in mid- 2007.