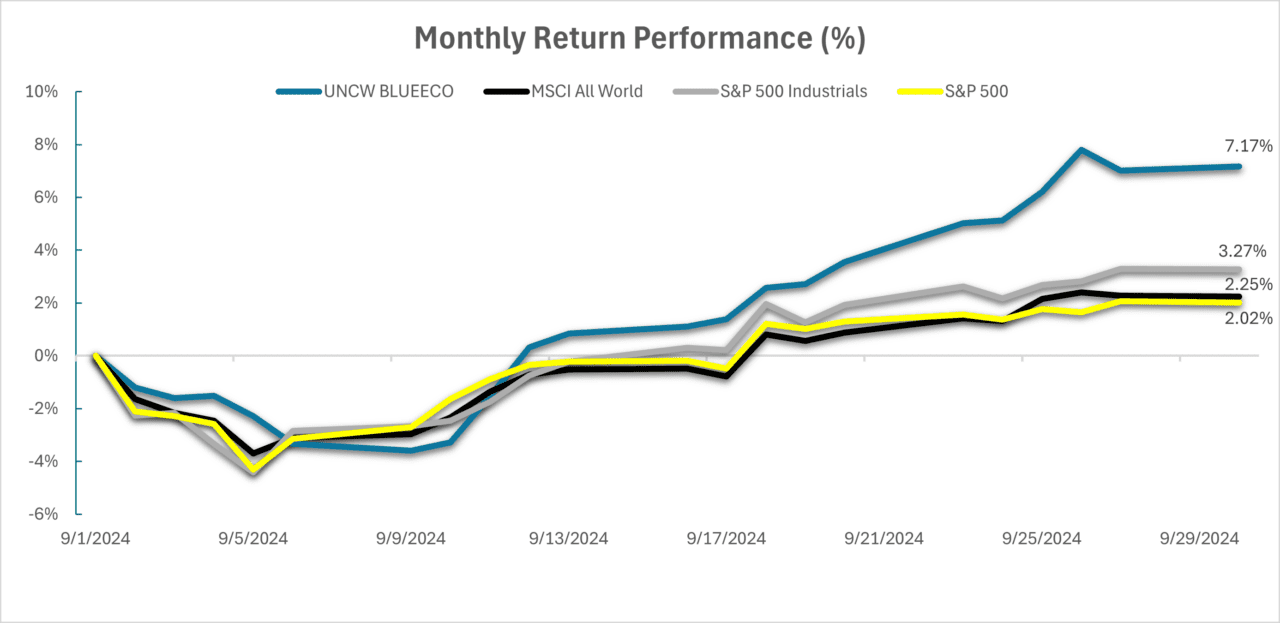

WILMINGTON – The University of North Carolina Wilmington Blue Economy Index, which measures the economic activities in the world’s oceans, rose by 7.17% in September and beat the performance of its closest benchmarks.

The UNCW index follows the World Bank definition of the Blue Economy and was developed in collaboration with the UNCW Cameron School of Business, UNCW Center for Innovation and Entrepreneurship, or CIE, CIE’s Alliance for the Blue Economy, and FactSet to quantify economic activities in oceans and waterways.

Supporter Spotlight

“With a particular emphasis on environmental impact, this index offers investors unparalleled insights into the burgeoning economic landscape surrounding coastal communities,” according to the collaborators, who said the index outperformed its closest benchmarks, the MSCI All World Index, the S&P 500, and S&P Industrials, during September.

The S&P Industrials showed a slight increase of 3.27% over the month, while the MSCI and S&P 500 lagged S&P Industrials but still delivered positive returns for the month showing gains of 2.25% and 2.02%, respectively.

“The strong performance from BLUEECO pushes the index to over 100% returns since its inception date in April 2018,” according to the collaborators.

Beijing-based Goldwind, the leading player in the wind energy industry, saw its share price increase by 31.3% in September and was the index’s top performer. It was the company’s strongest showing since 2021, and UNCW index collaborators said its profitability boosted investors’ confidence.

“Not only does the increase in net profits boost stock prices but industry trends have shown an adoption of renewables which correlates to Goldwind’s price rise,” collaborators said.

Supporter Spotlight

The energy sector boosted the index performance by posting returns of 11.17%. The materials sector, however, realized the lowest performance after posting 5% returns in August but maintained a positive contribution of 0.39%.

Singapore-based Marco Polo Marine, which provides vessel chartering for various marine operations and support for offshore companies, led the energy sector with its stock price rising by 22.33%.

Four companies saw returns of more than 20% September, including Norway-based Wallenius Wilhelmsen, a global shipping company specializing in vehicle transportation, that saw a 25.77% increase in September.

Wan Hai Lines of Taiwan saw a 24.72% increase during September.

“The growth of these Blue Economy companies should not go unnoticed, as The United Nations predicts extreme growth in the Blue Economy. Pointing towards growth from a current $1.5 trillion contribution to global GDP to $3 trillion by 2030,” collaborators said.

Mitsui E&S, a Japan shipbuilding, marine engineering and renewables firm, saw a loss of 11.7% over the month, making the company the worst performer in the index.

The UNC Wilmington Blue Economy Index does not feature any North Carolina-based firms among its U.S.-based holdings, “but three of our holdings have strong connections within the state,” Colin Waltsak, a research assistant in the UNCW Economics and Finance Department, told Coastal Review Wednesday.

They include General Electric, which has power-generation and industrial operations in North Carolina, recently invested in research and development in the state to advance technologies that support sustainable practices in the marine and coastal environment. The company saw an 8.15% increase in September, Waltsak said.

Houston-based Kirby Corp. also has a presence in North Carolina, where they focus on diesel engine services and marine transport. The company’s share price increased 2.09% during the month.

Standex International, based in New Hampshire, also has presence in the state in the food service equipment industry, specifically supporting sustainable fisheries and aquaculture, saw a 2.31% increase in September.