The University of North Carolina Wilmington said Wednesday that its monthly measure of ocean-related economic activities underperformed its closest benchmarks last month.

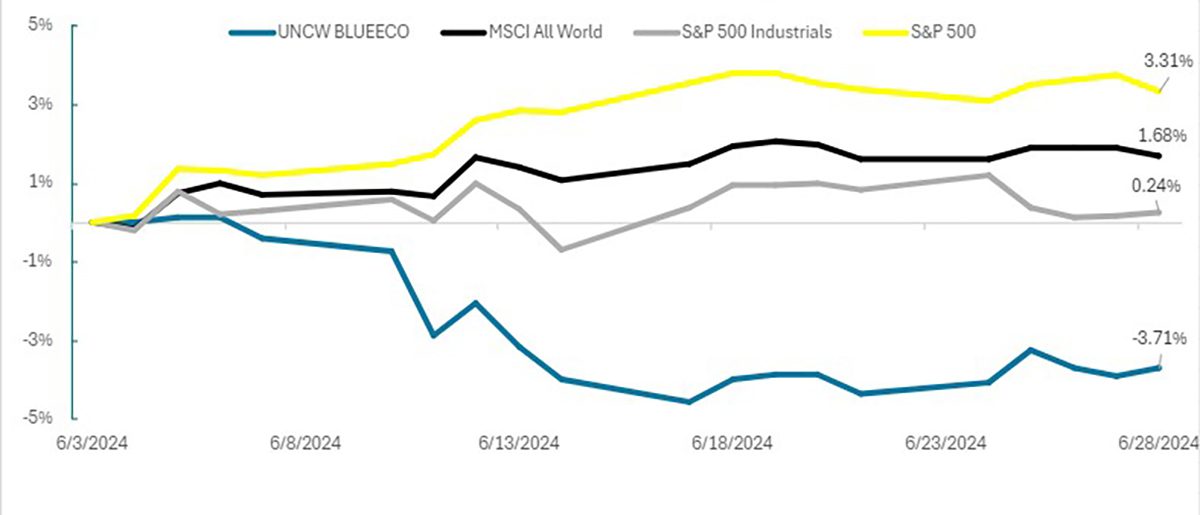

The index that measures economic activities in the oceans fell by 3.71% in June. It was the first time in two months that the index underperformed its closest benchmarks, the MSCI All World Index, the S&P 500, and the S&P 500 Industrials.

Supporter Spotlight

The index is published on Bloomberg (Ticker: BLUEECO), which provides daily financial data.

While the Blue Economy Index delivered the weakest gains throughout the month, its benchmarks experienced modest gains, UNCW announced. The S&P Industrials showed a slight increase of 0.24%, while the MSCI and S&P 500 competed for the top-performing benchmark with gains of 1.68% and 3.31%, respectively.

The collaborative attributed Blue Economy Index’ negative performance to a “pullback” from strong returns of more than 12% combined in April and May.

“Every sector contributed negatively to the index except for the Real Estate sector,” according to the UNCW collaborative. “Real Estate contributed to keeping the index from providing lower returns, and made the most significant contribution, posting returns of over 16%. This stunning performance comes from the stabilization of interest rates, and an uptick in mergers and acquisitions in the sector throughout the month.”

Coastal Review first reported on the UNCW Blue Economy Index June 7, noting that it was developed in 2018 but officially launched in February of this year. It’s a collaboration among the UNCW Cameron School of Business, the UNCW Center for Innovation and Entrepreneurship, CIE’s Alliance for the Blue Economy, and FactSet.

Supporter Spotlight

The UNCW collaborative said the index’ top performer was Lindblad Expeditions, a US-based cruise company that saw an increase of 26.47%, reflecting positive trends for the cruise industry.

The worst performer in the index was Nordex SE, one of the world’s largest wind turbine manufacturers. The company reported a 22.23% decrease attributed to order slowdowns amid rising second-quarter prices.

The renewable energy sector showed weak returns throughout the month as investors cashed in on gains, UNCW said.