First of two parts.

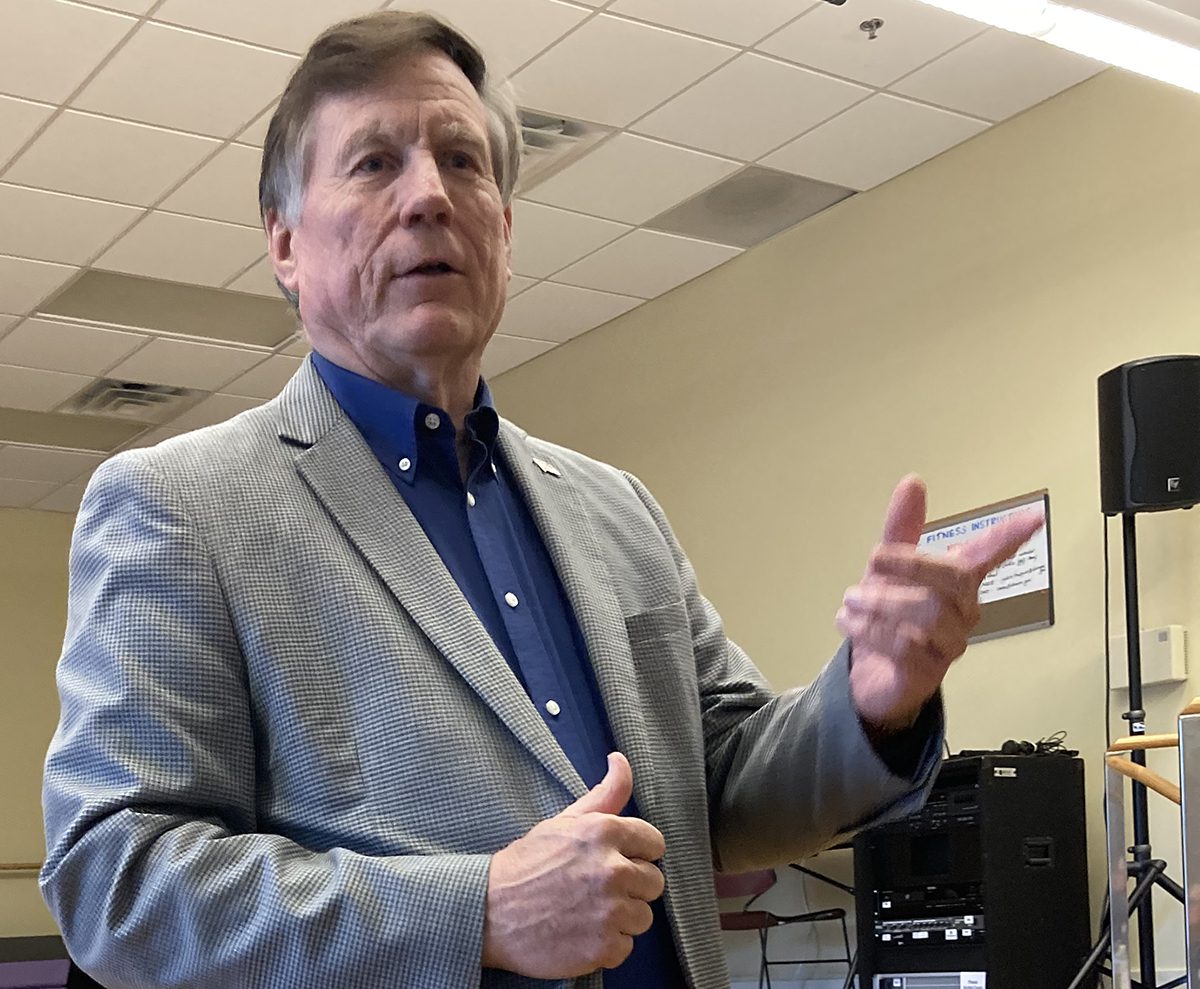

When Insurance Commissioner Mike Causey met last month in Manteo for a brief overview and Q&A with community members worried about property insurance issues, he stressed that his office had limited power over building code changes and insurance company business decisions in North Carolina that have unnerved homeowners.

Supporter Spotlight

First of all, he said, billion-dollar losses from storms, wildfires, floods and other disasters are worldwide challenges. But the property insurance industry in the U.S., where population numbers and real estate values are often highest in the highest-risk areas, is approaching its own survival crisis.

“It’s a very hard market right now across the United States,” Causey said. “Companies just don’t want to write homeowners policies.”

‘The only group that can change that system is the legislature.’

Mike Causey, Insurance Commissioner

Confronted with looming policy price hikes and feeling powerless to stop their insurance companies from pulling out of the state, frustrated homeowners are turning to the government for solutions.

“People say, ‘Why don’t you change the system?’” Causey said, responding to the audience’s questions about future insurance affordability and access. “The only group that can change that system is the legislature.”

Whether Causey, a Republican who is seeking reelection to the post he’s held since 2017, is shifting blame may be debatable, but it is evident from the last legislative session that focus on property insurance viability in the state was not a priority for the North Carolina General Assembly.

Supporter Spotlight

Rather than modernizing the state’s 15-year-old residential building codes, a step incentivized by lower property insurance costs, millions in government grants, and more resilient and efficient construction, North Carolina legislators passed a law, House Bill 488, that in much of the state banned inspection of exterior sheathing in structures exposed to winds of 140 mph or less.

The bill also removed authority from the North Carolina Building Code Council, a panel of industry specialists that had been working for months on updating codes, froze the old energy-efficiency standards until 2031 and directed creation in 2025 of a new separate residential council.

While the legislation is certain to deprive the state of available funds for climate resilience, it is also locking homebuyers into new housing that is built to outdated standards and thus more vulnerable to climate hazards. As a result, homebuyers will have increasingly higher utility bills, as well as structures more prone to damage in weather events, ultimately making their home more expensive to own.

“Everybody’s going to be paying quite a bit more for homeowners’ insurance because … our building codes are hopelessly out of date when it comes to residential construction in some areas,” said Kim Wooten, a member of the Building Code Council and the chair of the council’s ad hoc energy committee. “The other piece of this is that North Carolina is now going to lose hundreds of millions of dollars in grant money from the federal government to increase our ability to withstand flooding from flood events, storm events, weather disaster events.”

‘Our building codes are hopelessly out of date when it comes to residential construction in some areas.’

Kim Wooten, N.C. Building Code Council

The bill also allocated about $500,000 for staff members for the new residential council, which had been part of the existing Building Code Council, she said. Wooten, who was on the panel from 2008 to 2013 before rejoining about five years ago, is an engineer.

Anti-regulation sentiment in the legislature as well as persistent climate change skepticism, Wooten said, has contributed to lawmakers’ resistance to updating codes. The North Carolina Home Builders Association, which lobbied for the bill, had said that sheath inspection is unneeded and, along with energy-efficiency updates, would add an average of about $20,000 in costs to a new home.

But in an independent analysis Wooten conducted as part of her role with the energy committee while reaching out to green homebuilders, industry insiders and researchers, said that energy efficiency was consistently one of the five top things homebuyers want in a home — and the costs were “nowhere near” what the homebuilders claim.

“They just pulled a number out of a hat, which is the same number they pulled out of their hat five years ago, 10 years ago, 15 years ago,” Wooten said. “Yeah, it’s always $20,000.”

Zach Amittay, a Southeast advocate for E2, also known as Environmental Entrepreneurs, told Coastal Review that it’s understandable that the homebuilders’ group would want to protect their bottom line, but ultimately, the consumer and the taxpayer will be paying the piper.

“It’s going to become more and more financially untenable for folks to be able to have insurance, and then you’re dealing with more uninsured homes and then what happens after storm damage,” he said.

Less resilient construction often translates to more severe damage to both the interior and exterior, Amittay added. That leaves underinsured property owners unable to afford repairs or replacement of their home.

“That’s also the kind of thing that, in my opinion, the government should be taking steps to try and protect residents from these sort of outcomes,” Amittay said.

On its website, the North Carolina Home Builders Association said that “viable” code changes would have to be supported by data and follow proper processes.

“We work to develop and support cost-effective and affordable building codes, standards, regulations and state legislation in the construction area,” according to the website. “While safety is our priority, proposals also have to be examined for their cost-benefit and practicality.”

Typically, cities and towns in the U.S. base their building codes on recommendations that are updated every three years from the International Code Council, a Washington, D.C.-based nonprofit.

According to a Feb. 28 Swiss Re Institute report, at $97 billion, or 0.38% of gross domestic product, the U.S. suffers the highest economic cost “in absolute terms” from weather events in the world, mostly related to hurricanes. The Swiss Re Group is a leading global provider of reinsurance and insurance.

“The first step towards cutting losses is to reduce the loss potential through adaptation measures,” the report found. “Examples of adaptation actions include enforcing building codes, increasing flood protection, while keeping an eye on settlement in areas prone to natural perils.”

Each dollar invested in new building codes designed for construction that can better withstand storms can save $6 to $10 later, according to the report.

“Ultimately,” the report said, “losses as a share of GDP of each country will depend on future adaptation, loss reduction and prevention.”

Property owners on the Outer Banks and elsewhere on the North Carolina coast were shaken earlier this year by eye-popping proposed rate increases for homeowners insurance, averaging 42% statewide and as high as 99.4% in some coastal counties.

Rates in the state are set by the North Carolina Rate Bureau, which was established as a separate entity to represent insurance companies in the state, and operates independently of the insurance commissioner.

“It’s the largest rate request I’ve ever seen, (since 2017 when he took office) 42% state average, 99.4% in some counties. 25,000 letters and comments, including from associations and county boards, congressional delegations,” said Causey, who has challenged the Rate Bureau. But barring a negotiated agreement, Causey said he expects the rates will be adjudicated in court on Oct. 7.

“I haven’t seen the evidence to justify such a drastic rate increase on North Carolina consumers,” Causey said in a Feb. 6 press release.

Other insurance impacts weren’t as broad, but they can factor into future costs.

In February 2023, Nationwide insurance had notified the state that it would not be renewing 10,525 policies in North Carolina, about half of which were related to hurricane risk, spurring homeowners’ fears of more companies fleeing.

Then, in August, the legislature overturned Gov. Roy Cooper’s veto of H.B. 488, allowing the building code bans to go into effect.

Causey’s office had opposed the bill, and he said that his office “weighs in” on insurance company actions in the state such as Nationwide’s decision.

At the same time, a volatile property insurance market can spook real estate investors, and eventually, economic stability.

“It’s not going to be, ‘Can you afford it?’” Tanner Coltrain, agency manager at Farm Bureau Insurance in Swan Quarter, told Causey at the Manteo meeting, referring to insurance availability. “It’ll be, ‘Can you even buy it?’”

There may be some comfort in that North Carolina has what many consider one of the most innovative programs in the nation that encompasses resilience, insurance and consumer incentives and costs in one fell swoop.

The North Carolina Insurance Underwriting Association, or NCIUA, offers grants up to $8,000 for eligible homeowners toward roof replacement with what’s known as a fortified roof through its Strengthen Your Roof pilot program.

Studies have shown that as much as 90% of catastrophic insurance claims from storm damage are related to roof failures, and the NCIUA program has shown the effectiveness of fortifying roof construction.

But despite its proven track record, funds for the program were decreased during the General Assembly’s last session.

“We’re looking for the legislature to put more money into resilience,” Causey said.