NEW BERN – Public support for oil and natural gas drilling off the N.C. coast has been strong, according to an industry public opinion poll, but the rationale behind the “drill, baby, drill” fervor may be empty as a dry well.

That’s according to Laura Taylor, director of the Center for Environmental and Resource Economic Policy and professor of agricultural and resource economics at N.C. State. She was one of the presenters who spoke at the N.C. Coastal Federation’s recent forum, Shaping Our Economic Future: Offshore Drilling in N.C., held July 31 in New Bern.

Sponsor Spotlight

Taylor, in her presentation, explored the economic and other benefits that have been touted as reasons to pursue offshore drilling off the Atlantic coast. Enhancing the nation’s energy independence, lowering energy prices and creating jobs are the big three reasons often cited, but what’s the reality?

“We cannot be independent of a globally traded commodity,” Taylor said, referring specifically to petroleum products, for which prices are set on international markets.

Taylor said claims that increased domestic production of oil and natural gas would insulate the United States from certain trading partners and protect the nation from price shocks on international markets are “straw man arguments.” That’s because the U.S. supply is so small, relative to global production.

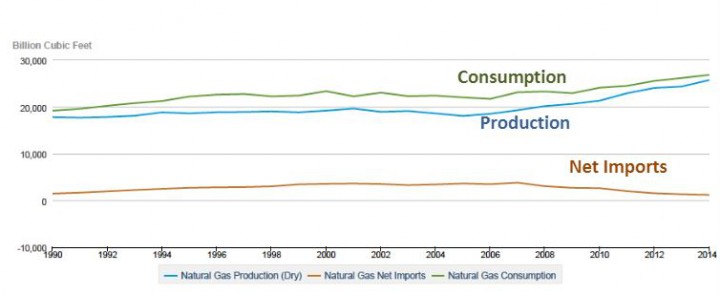

Likewise with natural gas, the amount of technically recoverable gas in Atlantic offshore reserves is expected to be a relatively small part of the market at probably less than 1.5 percent of the total. Also, within the United States, natural gas prices tend to vary regionally with prices in New England and South Atlantic states running higher than mid-Atlantic and other states and the overall U.S. average. But international markets for natural gas are changing, with prices in North America in the past decade falling lower and lower relative to prices in Europe and Japan.

Similar to the arguments ongoing since the 1970s in support of drilling in the Arctic National Wildlife Refuge, or ANWR, in Alaska, proponents say moving forward with drilling off the N.C. coast would create jobs and make America less dependent on foreign sources of energy.

Sponsor Spotlight

An American Petroleum Institute poll conducted earlier this year showed an overwhelming number of those questioned, 85 percent, agreed that increased production of domestic oil and natural gas could help strengthen America’s energy security. Also, 79 percent of respondents agreed that producing more domestic oil and natural gas could help strengthen America’s national security by lessening the negative effects of political instability occurring in other parts of the world. Eighty-six percent of those polled agreed that producing more domestic oil and natural gas could help lower energy costs for consumers, but public opinions don’t jibe with the reality of energy markets, Taylor said.

“We are already largely independent as far as natural gas,” Taylor said, adding that the United States is both an exporter and an importer of natural gas, with exports “growing dramatically since the advent of horizontal drilling.”

With regard to petroleum, the United States is producing 73 percent of its demand, according to preliminary 2014 numbers the U.S. Energy Information Administration released in February.

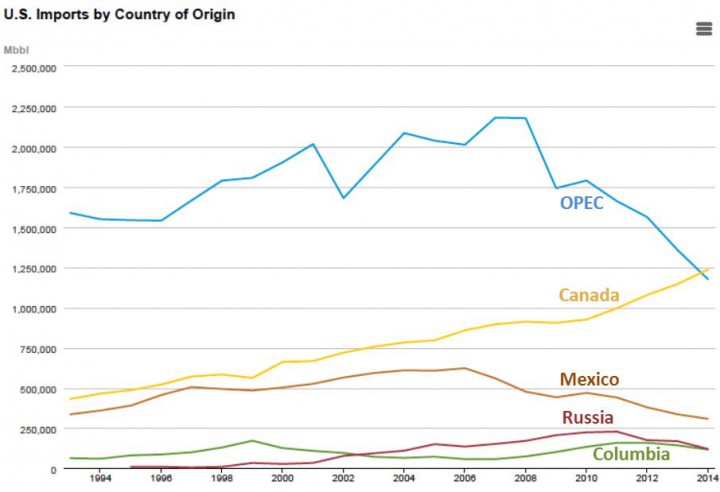

“We’re producing more and more of what we consume,” Taylor said, adding that OPEC is no longer the major source of U.S. imports.

If the motivations driving the push to drill are to insulate the United States from certain trading partners and provide protection from price shocks, then a certain level of success has already been achieved, Taylor said.

The United States has since about 1994 imported crude oil and petroleum products in decreasing amounts from member countries in the Organization of Petroleum Countries, or OPEC, and more and more from non-OPEC countries. Of the nearly 3.4 billion barrels of crude oil and petroleum products imported into the United States, Canada is the leader, providing 36.7 percent of total imports – about three times the amount imported from Saudi Arabia. Mexico provides about 9.1 percent and Venezuela about 8.6 percent of total imports. Other countries, such as Iraq, Russia and Kuwait, each contribute less than 4 percent of the total.

In terms of global crude oil reserves, which are estimated at 1.66 trillion barrels, and 2014 global production of 93 million barrels per day or 34 billion barrels per year, the most optimistic estimates of oil in the Atlantic outer continental shelf planning area amount to about one-half of 1 percent of global reserves, Taylor said. A more realistic estimate puts the Atlantic OCS reserves at less than a tenth of 1 percent of global reserves, according to figures from the Bureau of Ocean Energy Management.

The most likely estimates of ANWR reserves, about 5.7 billion barrels, amount to about 3.4 percent of U.S. daily consumption of 19 million barrels. If ANWR were fully developed, optimistic estimates put the effect on West Coast gas prices at a 2- to 3-cent per gallon drop, Taylor said. Taylor also disagrees with the prevailing opinion that more domestic drilling will lead to significant job creation here. Ninety percent of those polled believe more U.S. jobs would result from increased production of domestic oil and natural gas.

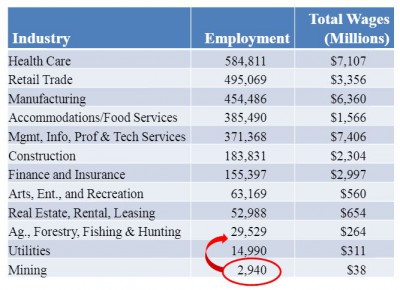

According to 2013 estimates, the estimated number of jobs in North Carolina resulting directly from oil and natural gas production off the coast is about 20,000 by 2035. Another 35,000 new jobs would be created as an indirect result, in other industries that spring up or existing industries that add staff in response to the economic growth.

Compared to current employment figures, which rank health care as the largest employer at nearly 585,000 jobs, the positions directly resulting from oil and natural gas industry growth would max out near the bottom of employment list as ranked by size. That’s fewer jobs than exist in the agriculture, forestry, fishing and hunting employment sector, which currently employs about 29,500.

In coastal North Carolina, the tourism industry is already comparable to mid-level predictions for oil and gas industry economic output 21 years from now, said Lee Nettles, director of the Outer Banks Visitors Bureau and another invited speaker at the federation’s forum. Nettles said the projected growth in the N.C. coastal tourism industry by 2035 is comparable to the highest economic benefit estimates for oil and gas industries, which top out at around the $5 billion mark by that time.

Also, the number of projected tourism jobs in coastal counties by 2035, based on current trends, is greater than the mid-level projection of oil and gas jobs by that time, he said.

Nettles said promises of economic benefit from oil and gas come at the peril of a proven tourism industry.

“Oil and gas is a threat disguised as an opportunity,” Nettles said.

Other economic considerations for the state include the possibility of sharing in the federal revenues from offshore oil and gas production. “Revenue sharing has long been seen as the biggest economic benefit,” Taylor said, adding that revenues of $855 million per year are projected for 2035.

Lawmakers from North Carolina, including Republican Sens. Richard Burr and Thom Tillis, and other East Coast states are pushing for a revenue-sharing agreement, but the Obama administration is opposed to new or expanded offshore revenue sharing.